Last summer California approved Assembly Bill 2113 which makes changes to its pesticide registration laws. Starting in 2025 there are new requirements for the California Department of Pesticide Regulation (DPR) to meet certain timelines for review of new pesticide applications and re-evaluation of registered pesticides. The bill also enacts increases to the California Mill Tax rate.

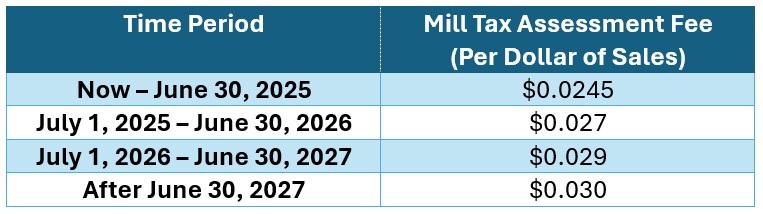

Mill Tax Increases

Assembly Bill 2113 raises the mill tax assessment rate for registered pesticides, which is a fee per dollar of sales. This increase is intended to bolster funding for pesticide regulation and safety programs within the state. The California Mill Assessment fee is changing per the following schedule:

Additional increases to registration fees may come in future years. On or before January 31st of each year, DPR must post on its website whether additional adjustments to registration fees during the calendar year may be made.

SRC monitors state and federal registration fee increases and notifies our clients as they arise.

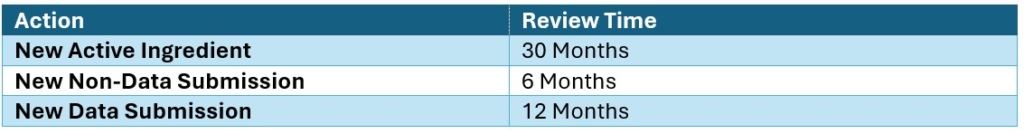

Registration Department Changes

This bill also introduces stricter timelines for DPR to review and make final decisions on applications for new and amended pesticide registrations. These new deadlines for review are set to begin on July 1, 2027 and follow the below timelines.

The bill also requires DPR to report average processing times annually, aiming for greater transparency and efficiency in the registration process.

Questions about how these changes will affect your current registrations and upcoming projects? Contact your SRC consultant to help guide you through this transition process.

Amy Toogood

Consulting Specialist I

Posted on: 05/14/2025

Christina Wilkinson

Consulting Associate

Posted on: 05/14/2025